Best options to choose a Quiety, to make your own app and grow your business

Empowering Finance Through Innovation

ARPS combine cutting-edge technology with financial expertise to deliver innovative fintech solutions tailored to your needs. Explore how we can transform your financial processes and drive growth in the digital age.

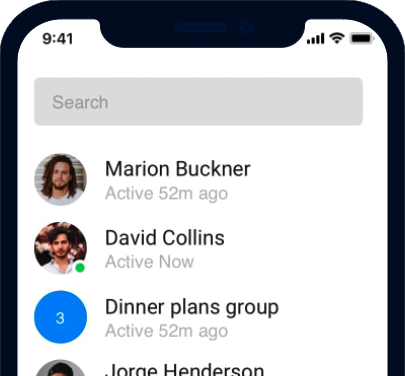

Custom Software Development

Tailored fintech solutions to meet your unique business requirements, from mobile apps and web platforms to backend systems and APIs.

Data Analytics and AI

Utilize data analytics and artificial intelligence to gain actionable insights into customer behavior, risk assessment, fraud detection, and investment strategies, driving informed decision-making.